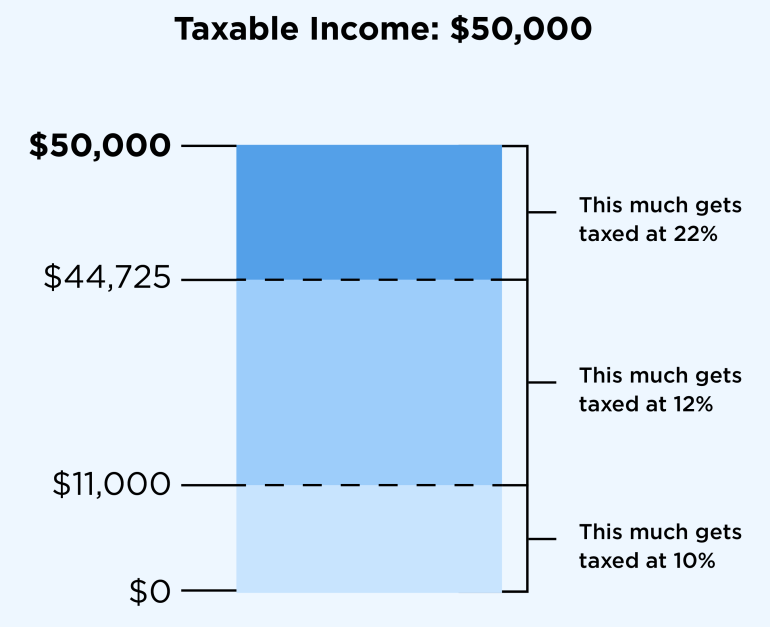

California Tax Brackets 2024 Calculator – For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, . There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. .

California Tax Brackets 2024 Calculator

Source : www.hrblock.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.nerdwallet.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.com

Covered California Income Limits | Health for California

Source : www.healthforcalifornia.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Ohtani Contract & California Taxes: $95 million at stake | abc10.com

Source : www.abc10.com

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

California tax guns January 1st 2024 question : r/CAguns

Source : www.reddit.com

California Tax Brackets 2024 Calculator Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®: How do tax brackets work? A single person with $140,000 in taxable income in 2024 would be in the 24% switched to an often-slower method of calculating it. At the time, the change was . An important part of this calculus is the capital gains tax – a government levy on profits reaped from investments. It applies to everything from your stock portfolio to your jewelry drawer. .